is preschool tax deductible 2019

The answer is no but parents can apply for a tax credit if they need childcare in order to work or find work. In 2019 Sam and Kate had childcare expenses of 2600 for their 12-year-old child.

Alumni Annual Fund Stem Students Financial Information Education

The school expense deductions are deductions from Louisiana taxable incomethey are not tax credits.

. Is private preschool tuition tax deductible. Caregivers providing child care services. It is not possible to deduct schooling expenses from your taxes.

This means that Sunday December 26 is your last Sunday in the year to contribute. Information to help determine the child care expenses deduction you can claim. Educational institutions for the part of the fees that relate to child.

Focus on Generosity. Although its primarily aimed at working parents and guardians the unemployed and full-time students may also. For parents who are responsible for childcare handling the cost of bringing up children can be challenging.

Sams earned income of 14000 was less than Kates earned income. Since at least if one or both parents were home while your child attended online preschool sessions then you would not be eligible to claim the child and dependent care credit. I have a question about a pre-kindergarten or preschool tax deduction.

The deduction will be reported on Schedule E of the Louisiana Resident Income Tax Return Form IT-540 as an adjustment to income and the Louisiana School Expense Deduction Worksheet must be attached to your return. Parents of incoming Montessori preschool students often ask if their childcare expenses are tax deductible. In contrast non-in-school childcare such as childcare programs in pre-K and up are deductible for purposes of the child care tax credit if otherwise approved as non-in-school childcare.

However you may qualify for the child and dependent care credit if you sent your child to preschool so you could work. The cost of private school including tuition cannot be deducted. Private school expenses including tuition are not deductible.

Last Sunday Left for 2021 Tax Year Deductible Gifts. Parents will also be pleased to know that the American Rescue Plan increases the credit received for the 2021 tax season. Can You Write Off Preschool Tuition On Taxes.

For 2019-20 the Childrens Fitness Tax Credit would amount to 60 million for 2020-21 241 million and for 2020-22 239 million. Of the 2600 they paid 2000 in 2019 and 600 in 2020. Line 21400 was line 214 before tax year 2019.

Preschool and day care are not tax deductible but you can be entitled to credits instead which could mean better tax benefits for you Paul. Is preschool tuition deductible. But preschool is considered childcare under the IRS code assuming you have a tax ID number for the preschool.

You can claim child care expenses that were incurred for services provided in 2020. Although preschool expenses do not qualify as a tax deduction on their own right you can claim them as part of the child and dependent care credit assuming you qualify. A credit called the Child and Dependent Care Credit worth up to 1050 for one child and up to 2100 for two or more kids.

Gifts must be received or postmarked by. Typically preschool expenses were only counted toward a child and dependent care credit and not a education credit or expense. 2021 Tax Year Deductible Gifts Deadline Friday December 31 Contributions must be postmarked by US Mail or dropped off at the church office in Mission by Tuesday December 31.

However expenses for a child in nursery school preschool or similar programs for children below the level of kindergarten are deductible for purposes of the child care tax credit if they otherwise qualify as child care. Those under the age of 16 who have filed taxes yet should still have a 15 refundable tax credit if they have incurred eligible expenses. If you paid a daycare center babysitter summer camp or other care provider to care for a qualifying child under age 13 or a disabled dependent of any age you may qualify for a tax credit of up to 35 percent of qualifying expenses of 3000 1050 for one child or dependent or up to 6000 2100 for two or more children or dependents for tax year 2020.

Tuition for preschool and K-12 is a personal expense and cannot be deducted. Must provide a copy of a current police firefighter. Canada Child Benefit CRA offers Canada Child Benefit which is a non-taxable benefit for each eligible family to cover the cost of raising children under the age of 18.

Expenses related to earning an income are only eligible for reimbursement if they directly relate to earning an income. The child care tax credit is available to children who otherwise qualify for child care but who are in nursery school preschool or similar programs. Are Preschool Expenses Tax Deductible.

As childrens schooling does not generate an income the expense is deemed private and therefore cannot be claimed. Is preschool considered tax deductible. Childcare is NOT deductible unless both spouses if married filing jointly work for pay are looking for work or in school FT.

Valid for an original 2019 personal income tax return for our Tax Pro Go service only. Thats why the IRS allows you to deduct certain childcare expenses on your tax return. Their adjusted gross income for 2019 was 30000.

Is preschool tuition deductible. The cost of private school including tuition cannot be deducted. You cannot deduct the costs of counseling litigations or personal advice.

These include payments made to any of the following. To assist us with the costs of being a parent the Canadian Revenue Agency CRA has provided a number of ways for families to save money through tax deductions and tax credits. Please go through the interview for the credit under deductions and credits to see if you qualify for this tax credit.

December 18 2021 Tax Deductions. Line 21400 was line 214 before tax year 2019. Day nursery schools and daycare centres.

However expenses for a child in nursery school preschool or similar programs for children below the level of kindergarten are deductible for purposes of the child care tax credit if. The sum of your childs entire preschool tuition is not tax deductible but you may be able to get something better than a deduction. As you contemplate year-end gifts please keep the church in mind.

Your Us Expat Tax Return And The Child Care Credit When Abroad

1 Tds Rate Chart Fy 2019 20 Ay 2019 20 Notes To Tds Rate Chart Fy 2019 20 Ay 2020 21 No Tds Tax Deducted At Source Chart Rate

Is Your Coffee Tax Deductible Economic Model Tax Deductions Thermal Energy

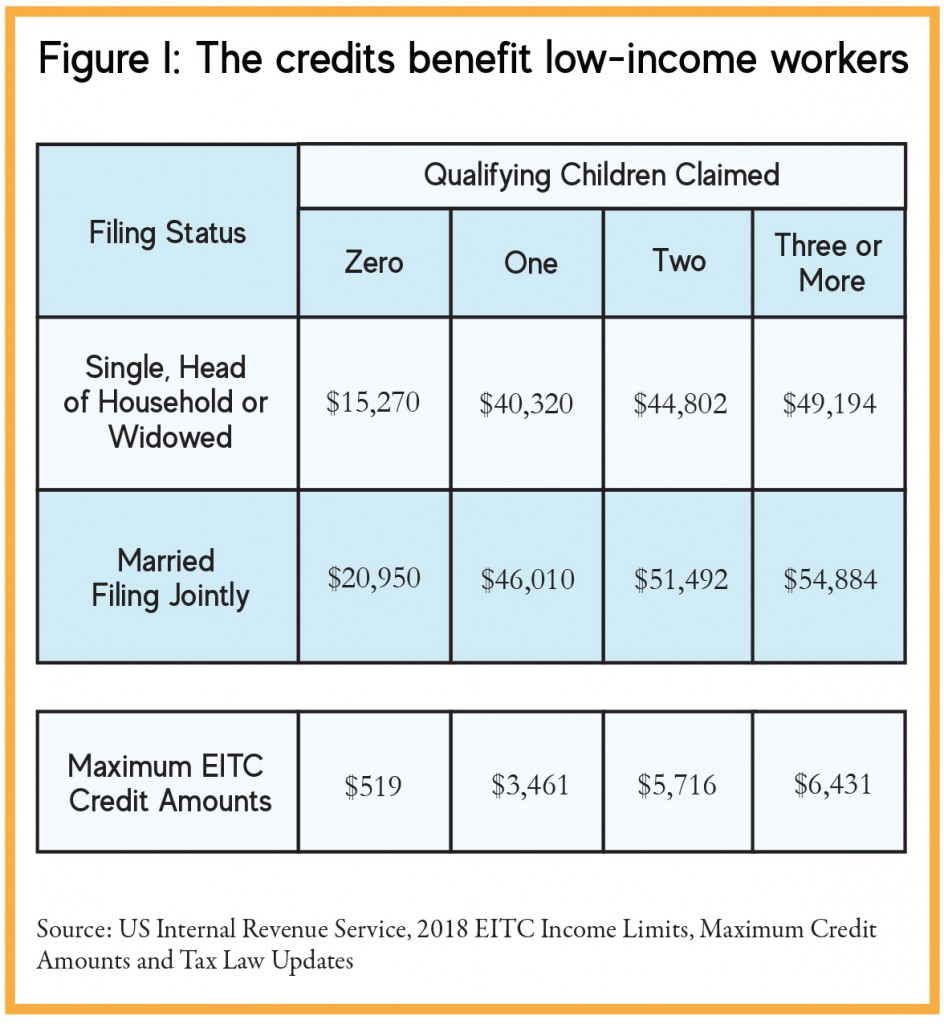

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

Tds Rate Chart Fy 19 20 Ay 20 21 Simple Tax India Tax Deducted At Source Chart Taxact

Get Our Example Of Child Care Receipt Template Receipt Template Invoice Template Childcare

Annual Information Statement Ais New Form 26as Notified In Income Tax Meant To Be Annual Income Tax

Pin By Tinytord On Personal Development Books In 2022 Tax Breaks Deduction Personal Development Books

How To Read Your Paycheck Stub Clearpoint Credit Counseling Cccs Credit Counseling Independent Contractor Payroll Template

Cheat Sheet Of 100 Legal Tax Deductions For Real Estate Agents Real Estate Tips Real Estate Quotes Real Estate Advice

Fish Theme Preschool Classroom Lesson Plans Preschool Lesson Plans Kids Learning Activities Preschool Lessons

Tds Rate Chart Fy 19 20 Ay 20 21 Simple Tax India Chart Tax Deducted At Source Preschool Writing

Is Preschool Tuition Tax Deductible Motherly

Tds Rate Chart Fy 19 20 Ay 20 21 Simple Tax India Rate Chart Tax Deducted At Source

Tds Rate Chart Fy 19 20 Ay 20 21 Simple Tax India Tax Deducted At Source Chart Taxact