omaha nebraska sales tax rate 2020

There are provisions in Nebraska statutes that allow both cities and counties to adopt a local sales and use tax. NU allows alcohol sales at Baxter Arena for University of Nebraska at Omaha hockey and basketball.

In 1996 the regents endorsed a lease at the Civic Auditorium for UNO hockey and gave the OK for.

. Nebraska Individual Income Tax e-pay EFT Debit Payments made through this website will have a company name of Nebraska Revenue when presented to your financial institution. Feb 16 2022 Feb 16 2022 Updated. Dakota County imposes a county.

Opponents filibuster bill to reduce top personal income tax rate in Nebraska DON WALTON Lincoln Journal Star. This name should also appear on the statement you receive from your financial institution. In addition local sales and use taxes can be set at 05 1 15 175 or 2 as adopted by city or county governments.

Proud To Be Local. The Nebraska state sales and use tax rate is 55. Are there county as well as city sales and use taxes in Nebraska.

Taxes And Spending In Nebraska

Sales Taxes In The United States Wikiwand

The Cities With The Highest And Lowest Property Taxes Real Estate Omaha Com

Taxes And Spending In Nebraska

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Cell Phone Taxes And Fees 2021 Tax Foundation

Removing Barriers In Nebraska Part Three How Our Taxes And Spending Compare

Which Cities And States Have The Highest Sales Tax Rates Taxjar

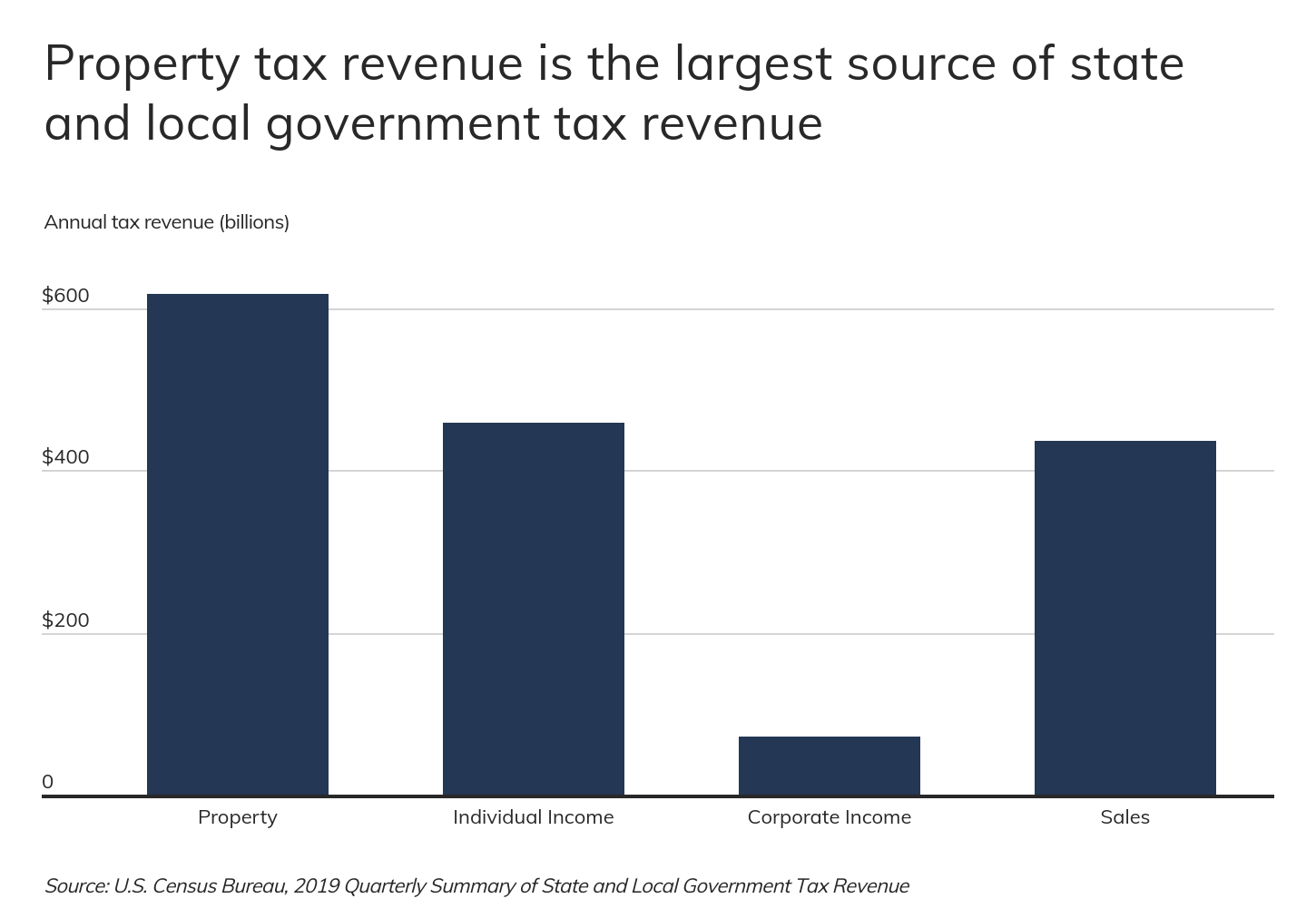

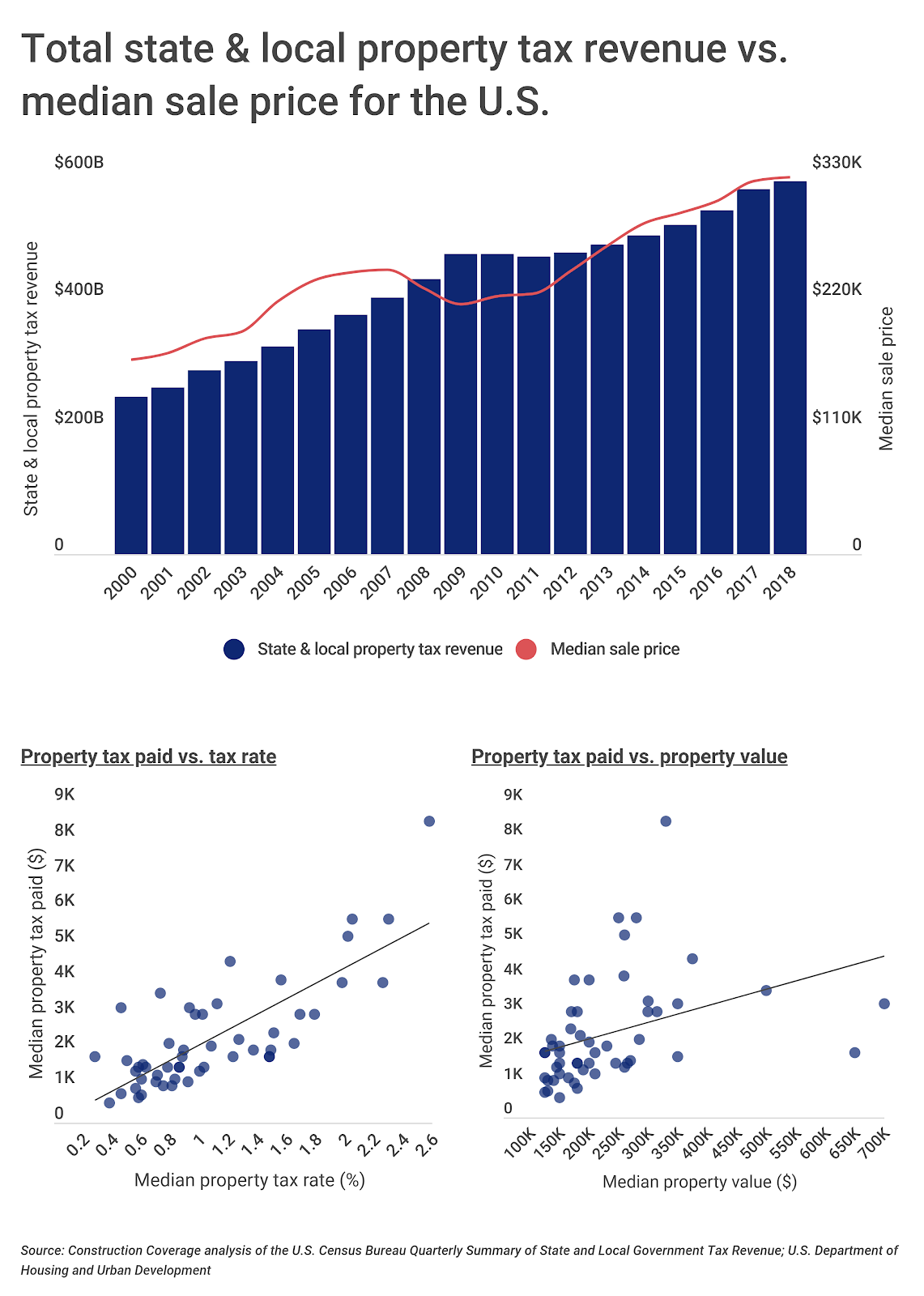

Fact Check Does Texas Have Some Of The Highest Property Taxes In The Nation State And Regional News Wacotrib Com

How High Are Cell Phone Taxes In Your State Tax Foundation

Sales Taxes In The United States Wikiwand

A Guide To Omaha And Nebraska Taxes

Tax Foundation Proposed Tax Rate Increases Undo Impact Of Property Tax Cuts